[ad_1]

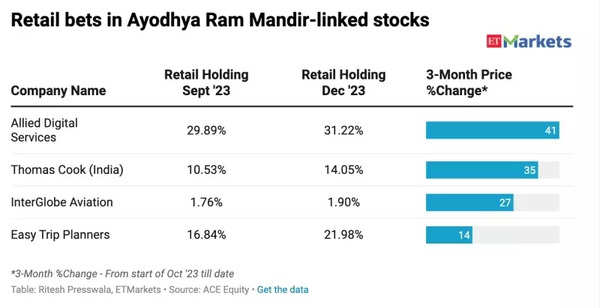

Data analyzed by ETMarkets reveals that retail investors have increased their investments in at least four Ayodhya-linked companies over the past three months.

Let’s take a look at how retail investors’ holdings in these stocks have changed from the September quarter to the December quarter, and how these stocks have performed.

Allied Digital Services:

Retail investors’ holdings in this company rose by 133 basis points in the December quarter, according to Ace Equity data quoted by ET. The stake of retail investors holding shares worth up to Rs 2 lakhs increased to 31.22% at the end of December, compared to 29.89% in the previous quarter.

Interestingly, foreign institutional investors acquired a 1% stake in the company during the last quarter. Shares of Allied Digital have rallied more than 41% since October, following the announcement of winning a contract for the Ayodhya Smart City Project.

Retail bets in Ayodhya-linked stocks

Easy Trip Planners:

The travel services provider also experienced an increase in retail holdings. Retail investors’ stake in the company rose sharply to 21.98% in the three months ending December, compared to 16.84% in the previous quarter. The stock has gained over 14% since October, with a 20% rally in the last month alone.

Thomas Cook India:

Similar to Easy Trip, Thomas Cook also witnessed increased bets by retail investors. Retail holdings in the stock jumped to 14.05% in the December quarter, from 10.53% in the September quarter. Shares of Thomas Cook have rallied 35% since October and reached a lifetime high earlier this month.

InterGlobe Aviation:

InterGlobe Aviation, the operator of IndiGo, was a popular choice among retail investors. Their stake in the company rose to 1.90% in the December quarter, compared to 1.76% in the September quarter. Ayodhya has become the 86th domestic destination for the airline, with services now available on the Delhi-Ayodhya and Ahmedabad-Ayodhya routes. The stock has gained more than 27% since October and reached a lifetime high earlier this month.

Road ahead

Spiritual tourism in India has witnessed steady growth post-pandemic, and experts believe this trend will continue in the near term. The government’s efforts to revive tourism across various sites in India are expected to contribute to the country’s GDP and attract long-term investors. Some of the recommended stocks by experts include IRCTC, Indian Hotels, Thomas Cook, Praveg, and InterGlobe Aviation, the report said.

While Ayodhya has become a new theme on Dalal Street and has influenced stock performance, the underlying outlook for many of these stocks remained positive even before. InterGlobe Aviation remains the top choice for analysts in the aviation sector.

[ad_2]

Source link