[ad_1]

On the last trading day of the financial year, the sensex jumped nearly 1% or 655 points to end at 73,651- less than 600 points short of its March 7 record high close.

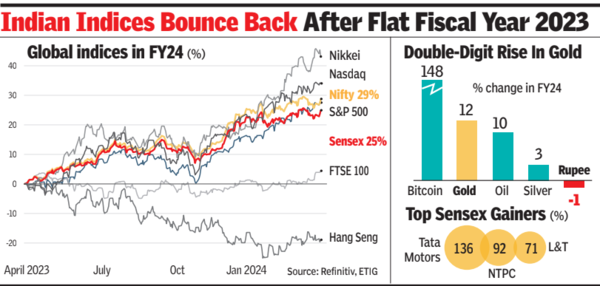

During the year as several of the old economy companies showed good future prospects, investors lapped up these stocks while the software exporters, FMCG and private banks witnessed muted buying interest, BSE data showed. Among the sensex stocks, Tata Motors more than doubled its value while state-owned NTPC nearly doubled. On the other side of the spectrum, HUL, Asian Paints and Kotak Mahindra Bank were among the top laggards.

The sensex was up 25% during the year while the broader Nifty rose 29%. Among the sectoral indices, real estate gained 129%, utilities 93% and power 86%. Among the laggards were bankex that gained 16%, FMCG 17% and financial services 22%, data showed.

Although the US continued to keep its interest rate higher, that raised chances of a selloff by foreign funds lured by higher risk-free rate away from risky emerging markets like India, extreme weakness in the Chinese market worked as a blessing for the domestic market. As a result, foreign portfolio investors net infused Rs 2.1 lakh crore into Indian stocks, the second best yearly flow on record behind Rs 2.7 lakh crore in FY21.

The weakness in China came at a time when the Indian economy showed strong resilience to a series of negative global factors. “India is a preferred destination for foreign flows due to the positive GDP outlook, impetus on manufacturing sector and structural reforms,” said Sanjay Bembalkar of Union MF.

[ad_2]

Source link