[ad_1]

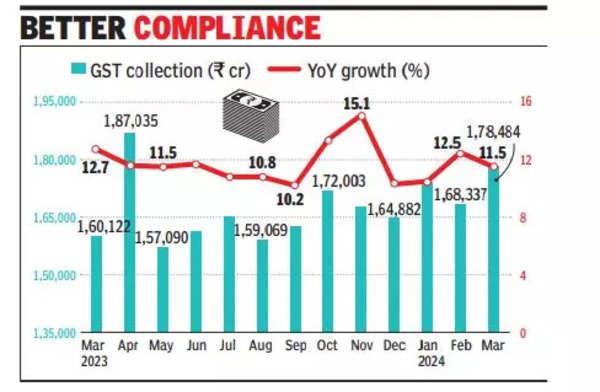

In March, overall collections during the month were driven by domestic demand as central and state GST collections grew 16.9% and 17.2%, respectively.

‘Record GST collections show eco resurgence across sectors’

Integrated GST mop-up, levied on inter-state transactions and imports, rose 6.1% to Rs 87,947 crore. A key reason for this was a fall in revenue from imports, which declined 5.1% at Rs 40,322 crore.

“Record collections during FY24 demonstrate the economic resurgence across sectors and was possible due to the various measures taken by GST authorities to improve compliance and stamp out evasion. The big focus on comparison of taxpayer behaviour across tax and corporate databases has also convinced businesses on the need to be compliant not only on their activities, but also keep track of their vendors’ tax behaviour and ensure that the entire value chain becomes compliant. Since all major states have recorded double-digit growth in GST collections – collections being also a barometer for economic activities as it’s a transaction-based tax – it can be reasonably inferred that the growth is across regions and sectors,” said M S Mani, partner at Deloitte India.

In March, barring Mizoram (29% fall), all states and Union territories with legislatures reported a sharp increase. On an overall basis, tax experts see this trend continuing. “The double-digit growth continues in monthly GST collections over last year. With this trend, it will not be surprising if the target for FY25 is revised when the main Union Budget is presented after the formation of a new govt. Also, the collections, which are only likely to be better in coming months, may pave the way for the next wave of GST reforms, including rate rationalisation,” said Pratik Jain, partner PwC India.

[ad_2]

Source link